Fraud exists in some form or another in all financial industries. Terrorist financing, drug smuggling, money laundering, and human trafficking all occur as a result of a lack of regulatory compliance. Another problem is the lack of strong compliance regulations, which expose organizations to grave consequences like data breaches and fraudulent transactions.

KYT compliance has made it very easy to tackle these issues, as well as assisting financial institutions in reducing the risk of suspicious transactions via fraud detection. Transaction monitoring software is one such solution that helps make financial transactions more simple for all financial institutions that engage in transactional activities, such as banks and money exchanges.

Why KYC is Not Sufficient?

Adherence to laws has become an essential component of combating financial crimes, due to increasing technological improvements in financial firms. Authorities are upgrading strict and harsh rules for all those who violate the law, considering how criminals are altering their techniques and how firms are showing leverage in AML as well as CFT compliance.

As a result, simply knowing a customer’s identity isn’t enough. To prevent fraud, businesses must be aware of each transaction and that could be achieved through KYT verification.

Why KYT Verification is Important?

AML regulations in the United States require all financial institutions. It handles transactions to take preventive measures in investigating and reporting any suspicious activity that could constitute a security risk.

In order to ensure compliance with anti-money laundering and client due diligence regulations, it is critical to recognize any unusual behaviour through transaction monitoring of checks, invoices, and other transaction models.

What is KYT Verification?

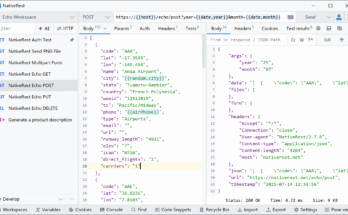

The practice of authenticating clients’ identities and checking their current transactions is defined as transaction monitoring, or know your transaction authentication. The primary purpose of transaction monitoring software is to discover senders or recipients who may pose a danger during transactions, as well as to prevent financial crimes. Furthermore, transaction screening aids in the identification of individuals on sanction lists, which aids in the prevention of money laundering.

Transaction authentication does more than just screen transactions; it also collects and evaluates bundles of data to keep fraudsters at bay. Transaction monitoring software is powerful, economical, and user-friendly. These know your customer transaction services offer financial institutions to streamline all transactions, providing them more control over evaluating and controlling transactions while still meeting regulatory standards.

KYT Solution Provider

Even though transaction scanning appears to be a simple task, it might take time. Financial companies develop policies and processes and collaborate with third parties in order to check transactions against old and new legislation and sanction lists.

While screening transactions, a company may encounter a variety of issues, including

- Revised legal requirements: To fight financial fraud, new and improved laws are passed often, making it difficult to keep up with them.

- Human error results in the omission of any member from the penalty lists.

- Giving rise to KYT limits.

Furthermore, if a customer has upgraded their techniques and discovered a way to wash their unlawful funds, both the company and the culprit will be prosecuted. Penalties will be imposed on both the criminal and the company for failing to detect the illegal activity in advance.

Benefits of KYT Screening

Transaction monitoring provides a number of benefits that makes it a reliable transaction monitoring system.

- Scans real-time data that can’t be faked or changed. Determines authentic merchant actions through qualitative and quantitative investigation.

- Assists in making decisions that are data-driven.

- Allows for very precise client data insights.

- Opens up more investigation routes by exposing hidden websites utilized for illicit activity.

- Dangerous stakeholders, like politically exposed individuals, and ultimate beneficial owners are revealed.

- Any unusual transaction trends or patterns, like transactions with an unknown person or company, are disclosed.

- Any shell firms linked to the company. It is involved in drug smuggling, terrorism financing, money laundering, or human trafficking are uncovered.

- Capable of adhering to customer due diligence, enhanced due diligence, and anti-money laundering requirements.

Final Thoughts

It’s critical to understand that knowing the client is not the same as truly knowing the consumer’s every transaction. As a result, all elements of transaction monitoring come down to a single point to quickly deal with high risk transactions and fraudsters. The use of transaction monitoring software should be the first option. Aside from being a reliable identification check. Transaction monitoring software provides a number of other advantages that should not be overlooked. It boosts the company’s trust while preventing financial fraud.